Oxide Raises $200M to Guarantee Independence Forever

Oxide Computer Company just raised a $200M Series C, and yes, you should do a double take. This is the same company that famously warned about the perils of raising too much money. So what changed?

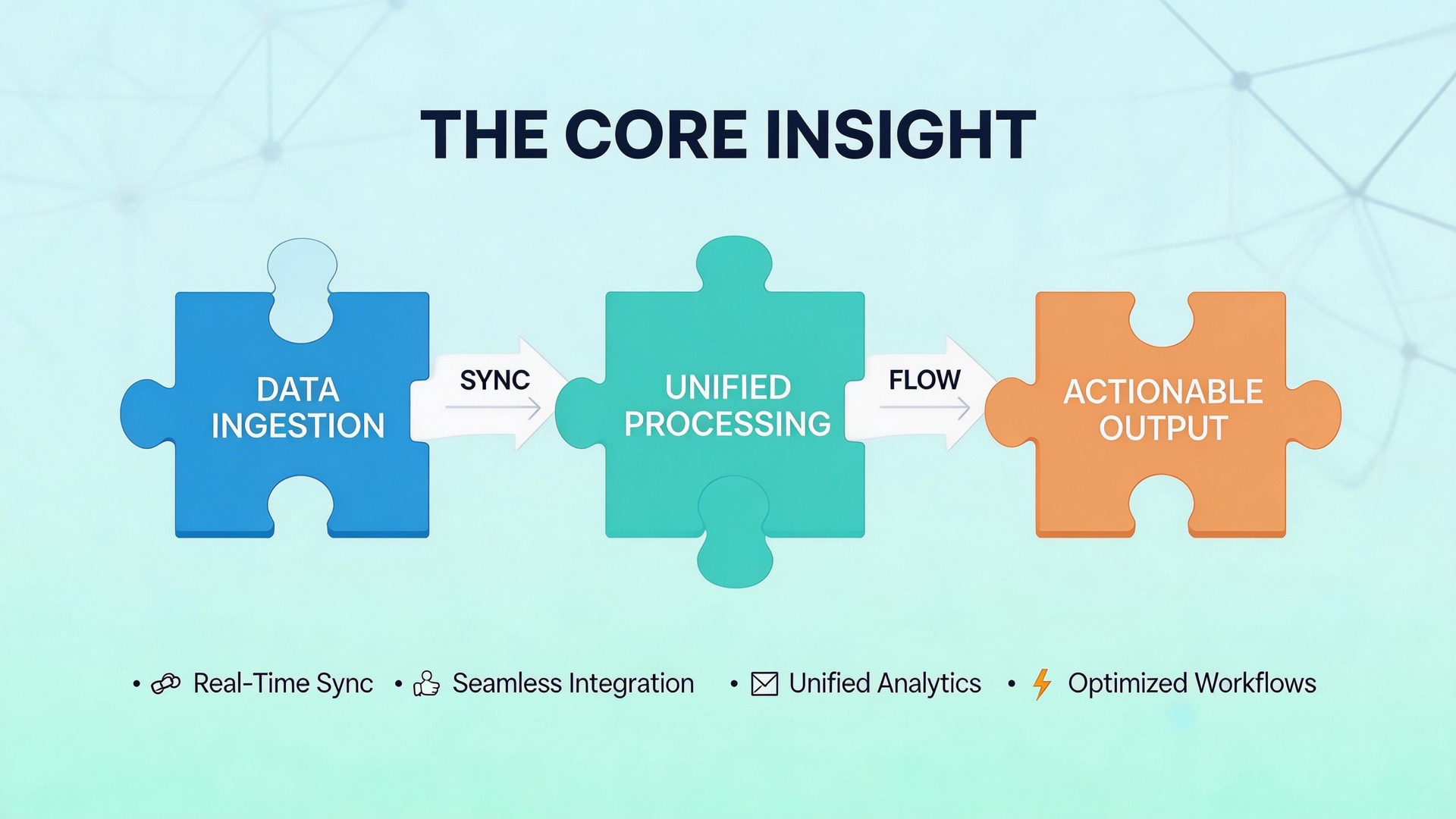

The Core Insight

Oxide didn’t need the money. That’s the key point. They achieved genuine product-market fit—people actually want to buy their hardware. Unit economics work. Cash conversion is positive. The business sustains itself.

So why take $200M from investors? Because their biggest risk was always time, and capital buys time. From their original 2019 pitch deck: the technical challenges are hard, talent is scarce, and market timing matters. Six years later, with the technical problems solved and a strong team assembled, removing capital risk means assured independence.

And independence, in the infrastructure world, is everything.

Why This Matters

Every infrastructure buyer has had their heart broken by promising startups that got acquired by established players. Oracle buys a company you bet on. VMware gets absorbed by Broadcom. Your innovative vendor becomes just another line item in a legacy giant’s portfolio.

Oxide’s customers now don’t have to just take their word when they say they won’t sell. They have the balance sheet to prove it. $200M in dry powder means the company can survive into “the indefinite future” without needing an exit.

This isn’t just about Oxide. It’s a template for how hardware companies can raise strategically: take money not when you need it to survive, but when you can use it to guarantee survival. The difference matters.

Key Takeaways

Product-market fit is real in hardware: Unlike many tech companies optimizing metrics while burning cash, Oxide has actual unit economics working. Physical products with real margins.

Raising from existing investors reduces friction: The Series C came entirely from existing investors who already knew and trusted the team. No new due diligence, no new relationship building—just confidence from people who’d already taken the leap.

Capital removes existential risk: Not needing to raise again means not needing to sell. That’s a concrete promise Oxide can make to customers worried about vendor stability.

Lucky breaks help, but execution matters: Broadcom’s VMware acquisition strategy created market opportunity. But Oxide was positioned to capture it because they’d done the hard technical work first.

Life’s work, not means to end: The founders explicitly frame Oxide as generational, not transactional. That philosophy shapes everything from capital strategy to customer relationships.

Looking Ahead

The cloud infrastructure market is entering a new phase. On-premise computing is attractive again—for sovereignty, for cost control, for AI workload density. Companies like Oxide that can deliver cloud-like experiences in private data centers have real wind at their backs.

With capital risk eliminated, Oxide’s constraints are purely execution: can they deliver hardware fast enough, can they scale support, can they expand their product line? Those are good problems to have.

Their mission, from RFD 0002: kick butt, have fun, not cheat, love our customers, and change computing forever. With $200M in the bank and no need for an exit, they’ve got runway to try.

Based on: “Our $200M Series C” from Oxide Computer Company